Understanding How the Real Estate Market has Shifted in 2022

Economic uncertainty has been a major talking point across all industries over the last few months. The federal reserve has steadily been increasing interest rates in an effort to combat inflation, while supply chains have suffered due to countless factors, most notably the Russia-Ukraine war and renewed COVID-19 lockdowns in China.

Just like the public equity sector, real estate has been adjusting to the current economic and financial climate after a period of unprecedented growth. What changes have we seen in the private real estate sector?

Rent Growth Has Slowed Significantly or plateaued in Every Market Across The Country

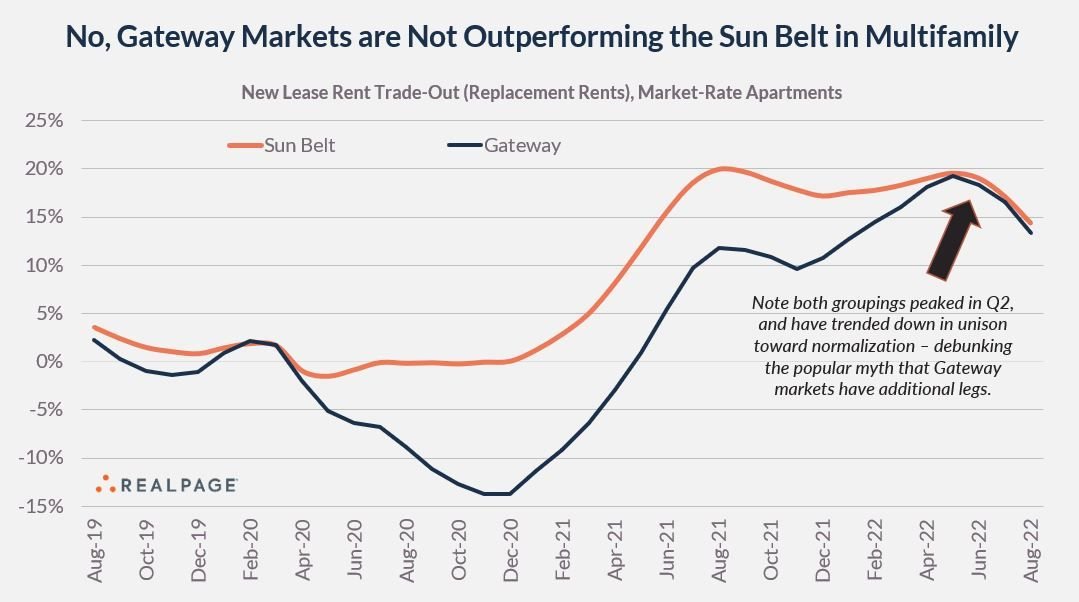

The Sunbelt has experienced unprecedented recent rent growth. Most real estate market participants predicted that the Sunbelt rent growth would stagnate first while other markets that did not experience such high growth in recent years would continue growing. Rents in gateway markets (NYC, LA, SF, etc) fell from March 2020 - May 2021 and most predicted they would begin now increasing at a faster rate than Sunbelt markets.

This is not happening. All markets have rent growth decelerating and are slowing at the same time.

This chart originally appeared on LinkedIn in a post from Rental Housing Economist Jay Parsons.

Interest rate increases have made securing favorable debt terms increasingly difficult

Increases of the 10-year treasury rate have significantly increased the cost of debt for real estate acquisitions across the nation. This severely affects how much interest owners will pay for new fixed rate loans, and applies to all real estate asset classes. Mortgage rates are approaching 7.0%, and in the multifamily sector we have seen new fixed rate bank loans being quoted in the 5.75%-6.25%.

Additionally, banks have become more reluctant to lend on new real estate acquisitions. As rates increase, owners are less incentivized to refinance their current loans–meaning banks are receiving less loan payoffs, which are large payments they typically then prepare to lend again on another property. This is not happening and banks are also under pressure from customers pulling deposits to invest in treasuries.

Debt funds, which have been an alternative to bank financing, saw increased popularity over the past few years due to their favorable debt terms. These loans are almost all variable rate and as SOFR (their preferred index) kept increasing, they have fallen out of favor from private real estate investors.

As lenders become more restrictive with how much they are willing to lend, and rates continue to grow, we are likely to see less listings & buying activity across all commercial property sectors.

A looming recession has made investors more cautious as they evaluate potential investment opportunities.

Buyers have been adjusting their investment criteria almost on a daily basis in the multifamily sector. Among them, we have seen:

Rent growth assumptions decreased.

Exit cap rate assumptions increased.

Higher going-in cap rate thresholds.

Higher loan interest rates.

Increased expense costs, in particular real estate taxes and insurance in the Sunbelt.

While not an exhaustive list, it gives an idea of what operators are doing during this period of price discovery and debt market uncertainty.

A Period of Price Discovery

The previous factors have led to a period of price discovery across different asset types and markets. In locations where valuations cap rates had been lower due to priced-in rent growth assumptions, we have seen values drop anywhere from 15-25% in multifamily. In contrast, markets that were already trading at higher cap rates have saw smaller decreases in value. In Chicago, for example, prices have appeared to have decreased 0-10%.

Additionally, some asset classes are still a mystery even among the most informed industry professionals. Office and hotels have both not been trading in the market over the past few months, leaving their current price adjustments up to speculation.

What should owners be doing right now?

Adjust hold periods: Assets that were acquired with the intention of holding for 1-2 years will not be able to be sold for the same values similar assets would have priced for around 6 months ago. Owners should consider shifting their investment horizons to accommodate for a short-term climate of lower asset pricing and extend their hold periods accordingly.

Look for loan assumption deals: Many commercial loans are assumable to a future buyer. As new loans become increasingly difficult to align with business strategies in certain markets, the prospect of assuming an existing loan on a property becomes more attractive to investors. Expect to see more deals being offered with loan assumptions and an increased appetite for them in the coming year.

Trading up in quality: Price decreases are universal across all levels of asset quality. This is an opportunity to acquire class-A properties in prime locations at discounts. Investors should consider acquiring better assets while prices are lower, which historically has seen their values recover sooner after downturns.

Focus on opportunities with immediate cash flow: Investors should consider markets and opportunities that generate immediate cash flow. This cash flow allows investors to “get paid to wait” for the market to recover and provides protection against negative cash flow if rents decrease.

To learn more about the current state of the real estate market, please watch our latest market update podcast hosted by our founder, Drew Breneman by using the links below:

About Breneman Capital

Breneman Capital is a private real estate investment management firm specializing in the multifamily property sector. Breneman Capital employs a deliberate investment approach, leveraging data analytics and proprietary technology to generate superior risk-adjusted returns for investors.

To begin receiving high-quality investment opportunities from us, sign up here today: