Does the Fed Funds Rate Increase Impact Fixed Rate Mortgage Interest Rates on a 1:1 Basis?

The Federal Reserve increasing or decreasing the target federal funds rate does NOT correlate with an exact 1:1 increase or decrease in the interest rates available to real estate investors for long-term fixed-rate mortgages.

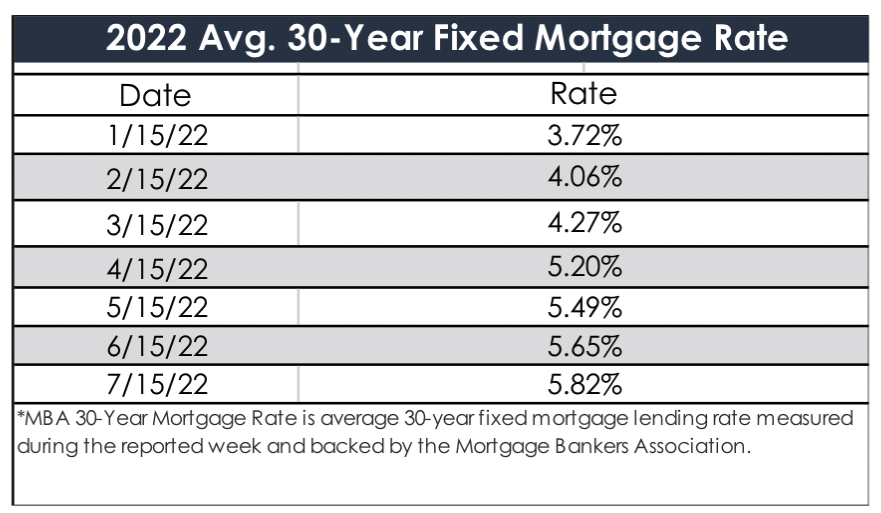

The Federal Reserve increased its target fed funds rate by 75 basis points (0.75%) on June 15, 2022, and 75 basis points (0.75%) on July 27, 2022, and the question of how much this changes long-term fixed-rate mortgages is on the top of the mind of many investors. It is commonly misunderstood by many in the real estate industry.

Many believe that when the Federal Reserve increases the target fed funds rate by 0.75%, fixed-rate mortgage rates will increase by exactly 0.75%. Even the Federal Reserve disagrees this is the case:

“…In contrast, the interest rate on a 10-year Treasury bond does not appear to move as closely with the fed funds rate. While there appears to be some co-movement, the 10-year interest rate appears to follow its own declining path.”

The 10-year treasury bond referred to above is highly correlated to 30-year fixed rate mortgage rates as shown in the charts to follow.

Phil McAlister, economics expert, and Drew Breneman dove even deeper into this topic on a recent podcast:

What The Fed Can Do

The Federal Reserve's primary role is to encourage price stability and maximum employment by managing the monetary policy of the United States, which translates to controlling the money supply in the national economy. The Fed has several tools to conduct policy, including quantitative easing, managing the target federal funds rate, and conducting open market operations. Adjusting the target federal funds rate is the Fed's most influential and effective tool for enacting monetary policy. For context, the target federal funds rate is the interest rate banks charge each other for overnight loans of reserves deposited at the Fed, essentially setting the floor for all other interest rates on government and private debt.

Effects of Raising the Target Federal Funds Rate

To temper inflation, the Fed raises the fed fund rate without significantly reducing economic output and employment. Reducing inflation by raising the fed funds rate is a delicate exercise, and there is no historical blueprint to follow in this case.

Raising the target federal funds rate impacts other short-term interest rates significantly, and we expect short-term rates to increase in conjunction. The graph below shows how closely the federal funds rate relates to the 1-year and 2-year Treasury bond yields.

Conversely, there is no clear correlation when we graph the historical 10-year Treasury yields to the short-term interest rate movements (fed funds & 1-year Treasury yield). The 10-year Treasury interest rate follows a declining and independent path. 10-year Treasury bond yields reflect the long-term economic outlook of the US, incorporating GDP growth, inflation, and other perceived economic forecasts.

Furthermore, the 10-year Treasuries are the basis for a mortgage and other commercial loan rates. They represent the "risk-free" floor rate, on which the lender adds a rate spread to account for the additional risk. Below represents the close correlation between 10-year Treasury yields and average 30-year mortgage rates. We can see how closely the two move together and the risk-adjusted spread in the mortgage rates to account for the higher risk, lower liquidity, and longer term.

If we analyze the federal funds rate, the 1-year Treasury bond yield, and the average 30-year mortgage rates, we can see that mortgage rates are not as related to the fed funds rate as one might assume. We cannot definitively say that raising the federal funds rate will lead to sustained 30-year fixed mortgage increases.

Variable Rate Loans

We should note that the above referenced long-term fixed-rate loans and the charts above referenced the average 30-year mortgage rates. Variable rate mortgages are impacted by the Federal Reserve increasing the fed funds rate. Many loans originated by debt funds and other variable rate lenders have interest rates that fluctuate monthly or other frequencies over an underlying index (index is most commonly SOFR). For example, the Secured Overnight Financing Rate (SOFR) is a short-term rate highly correlated with the fed funds rate. Thus, if we invest in real estate with a variable rate loan, we know the fed funds rate and variable rate will be highly correlated.

Hear more on the Breneman Blueprint Podcast by clicking below:

The Great Unwinding

In May 2022, the Fed announced that it would start reducing its balance sheet in June by $30 billion monthly in Treasury securities and $17.5 in agency mortgage-backed securities. In September, this unwind will accelerate with much monthly larger caps ($60 billion for Treasuries, $35 billion for MBS). This reduction may lead to increasing 30-year fixed-rate mortgages as the Fed moves away from being a buyer in the MBS market. An era of higher volatility and higher bond yields will begin, which raises the "risk-free" floor of a mortgage rate.

About Breneman Capital

Do you want to expand your real estate investment portfolio but don’t know where to start?

Breneman Capital is a data-driven multifamily investment firm pushing the real estate industry into the future with a modern approach to direct real estate investments.

We focus on providing our investors with the best risk-adjusted investment opportunities in carefully selected markets across the U.S., researched and underwritten with extreme detail from our headquarters in Chicago.

The best part, you can diversify your investment portfolio into real estate without the usual time commitments of managing a complex web of vendor and contractor relationships.

To begin receiving high-quality investment opportunities from us, sign up here today: