5 Essential Real Estate Performance Metrics for Predicting Success

Breneman Captial is a data-driven multifamily investment firm, and our data science team obsesses over identifying the best data to forecast critical multifamily real estate performance metrics years into the future. Our goal is to fine-tune and backtest our models for predictive accuracy perpetually—we are always hypothesizing factors that may drive performance. Then we relentlessly pursue and test that data.

Real Estate Performance Metrics to Watch

In multifamily real estate, there are countless metrics useful for underwriting properties and understanding markets/submarkets—none of which are more vital to investment performance than capitalization rate ("cap rate") and rent growth.

The cap rate is a measure unique to real estate that compares a property's operating cash flow before debt or net operating income ("NOI") relative to that property's total value. The formula for calculating cap rate is below:

NET OPERATING INCOME / PROPERTY VALUE = CAP RATE

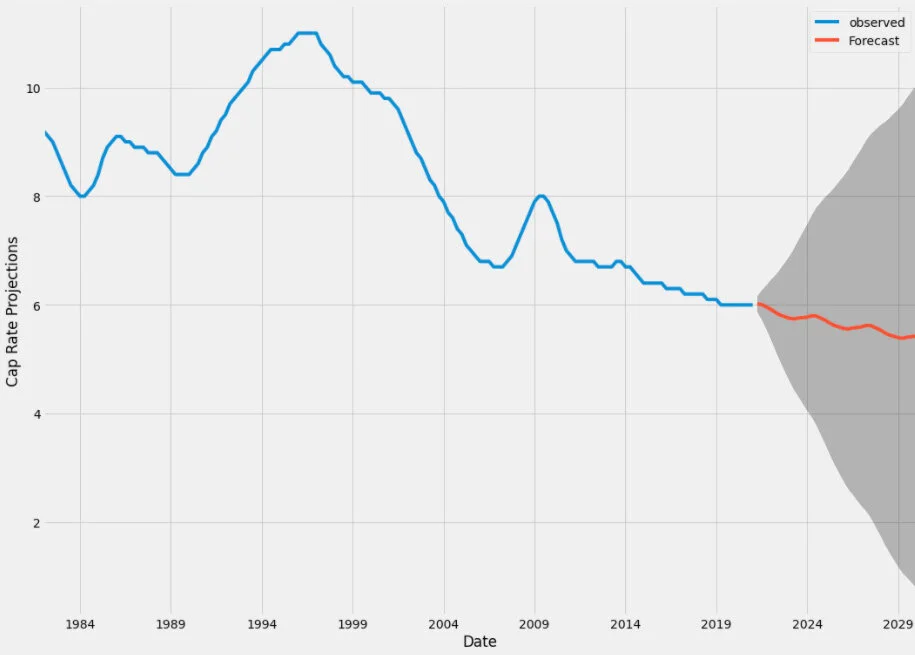

As the cap rate is the primary indicator for a property's value, the movement between an investment's cap rate at the time of purchase and sale (not to mention the time elapsed between purchase and sale) is an enormous factor in determining total returns. As such, we greatly value understanding how cap rates are expected to change in our target markets over the coming years, and doing so gives us insight for developing our strategies.

In addition to cap rates, Breneman Capital (formerly Rise Invest) forecasts rent growth in hundreds of markets via multivariate and simple machine learning models. Another critical assumption in underwriting, rent growth is notoriously difficult to project accurately, and it's become commonplace for many real estate investors to underwrite their investments with constant inflationary growth. Thus, even minor improvements in projecting how rents will grow on both market and submarket levels can be a significant competitive advantage, as using only conventional underwriting methodologies can lead to missed opportunities and/or overvaluing less favorable investments.

Models

To forecast these aforementioned metrics, we develop proprietary models that deploy machine learning to generate original insights, helping pioneer our industry to a new standard. Our data science team makes the most of technology, utilizing Amazon's AWS infrastructure for cloud-based computing to maximize the efficiency of our models and developing with Google-designed machine learning tools—industry standards to ensure quality.

Visualized output of a model that forecasts cap rates.

Five Data Points We Have Found to Be Influential for Multifamily Investment Performance

We have acquired a diverse and robust array of datasets for factors relevant to multifamily investment performance. Below are five critical data points that our forecasting models incorporate to generate insight into how we expect multifamily real estate fundamentals to behave.

Household Income: Household income has been proven to be a valuable indicator in real estate for asset quality, rent growth, and cap rates. The cost of housing is typically the most significant expense for individuals and families, so the quality of property and neighborhood, as well as rent level all tightly, correlate with how much income a household generates.

Population Growth: A crucial factor for growing rents is increasing demand. Outsized rent growth is likely to occur if population growth outpaces the delivery of new housing units.

Job Growth: Job growth, like population growth, is an excellent indicator of rent growth and cap rate compression. Job growth has many residual benefits to economies, including rising incomes, increased job diversity, and growing housing markets.

Population by Age: Population growth on its own is essential, but another fantastic predictor of multifamily performance is the splits by age cohort. Areas, where there are many young adults (age 20-34) will typically have healthy multifamily markets due to a consistent portion of the population being renters. Additionally, new amenities generally flock to areas with younger populations, enhancing these areas' vibrancy and desirability.

Job Sector Data: A key determinant of asset quality and rents is job sector data. In heavily industrial areas, it is expected that the majority of supply is older B and C level properties, whereas financial and tech districts are more likely to find luxury housing. Knowing a submarket's job sectors allows for an enhanced understanding of which types of properties to target, the expected renter base, and the most appropriate investment strategy.

Breneman Capital For You

Breneman Capital is a data-driven multifamily investment firm pushing the real estate industry into the future with a modern approach to direct real estate investments.

We focus on providing our investors with the best risk-adjusted investment opportunities in carefully selected markets across the U.S., researched and underwritten with extreme detail from our headquarters in Chicago.

The best part, Breneman Capital uses these five real estate performance metrics and many more to find and strategize the best multifamily investment opportunities available across the best markets in the country.

To begin receiving high-quality investment opportunities from us, sign up today: